#Bevening out family cashflow budgeting software#

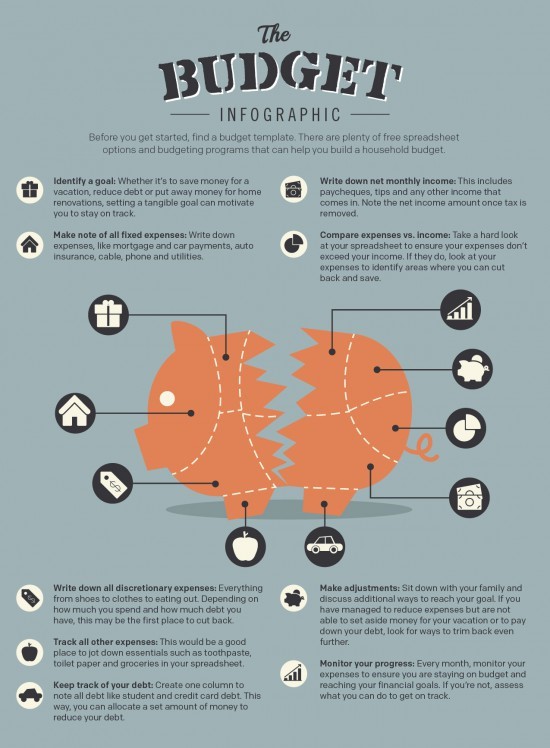

If you use an expense-tracking software program like Mint or Quicken, you should have this information at your fingertips.

It's also important to keep an eye on spending when you’re retired, too, as outlays rate will be a key determinant of whether your portfolio lasts over your retirement time horizon. To help ensure that you can meet your long-term financial goals, it's crucial to track and manage expenses throughout your life, not just when you're starting out and getting your financial footing.

(Few people envision radically cutting back on their lifestyles in retirement.) That's a particular problem if overspending crimped the ability to save during the accumulation years. Lifestyle creep also poses challenges from a retirement standpoint because cash flows from all sources-Social Security, pensions, and portfolio withdrawals, to name the three biggies-must support the heightened level of spending. Income may be insufficient to support the elevated level of spending that the worker has grown accustomed to and/or crimp the ability to save. While the typical worker sees cumulative earnings growth of 127% between the ages of 25 and 55, that trajectory can be jagged earnings often level off or even decline after the worker reaches his or her mid-50s.

We may be busier so we need to hire more helpers-dog walkers, house cleaners, and landscapers, for example.Īs Kitces details in this thought-provoking post on his Nerd's Eye View blog, that lifestyle/spending creep can be problematic from a couple of different angles. Our houses get bigger, our date nights get more elaborate, we acquire preferences for better food, cars, and clothes.

Think budgets are only for people just starting out? If so, you're probably not familiar with what financial planning guru Michael Kitces calls "lifestyle creep"-the tendency for our spending to increase right along with our earnings. A version of this article originally published in June 2019.

0 kommentar(er)

0 kommentar(er)